Hey all. Writing this a few days after the 12/6/23 Q3 10Q release from GameStop, which showed the third consecutive stagnate reporting for DRS ownership (after controlling for Mainstar un-DRSing 1.2million shares during Q2).

Why are the DRS numbers stagnant?

From my perspective, there are 3 possible explanations / hypotheses.

-

The DTCC is somehow “making GameStop report these numbers”. This is currently a popular take on social media. Ryan Kagy called it confirmed on Twitter. Top posts on Superstonk claiming something was off from users like dreadfulol and welp007, to give some examples. A common sentiment in the threads linked is that the DTCC or SEC are forcing the report language or findings somehow.

-

The report is accurate, and DRS numbers are actually stagnant.

-

The report is accurate, and DRS numbers drawn for the report are being manipulated.

For the purpose of this DD I need to be clear that I don’t believe #1 is possible. GameStop controls the issuer ledger, Computershare manages it for them. I believe they are reporting accurate information, and the numbers reflect what they have access to on the record date.

2 is possible, wouldn’t be able to prove or disprove, but the community is still strong. Anecdotally, I increased my DRS position 9% this quarter.

3 is what I believe to be the case. I will explain how this could be done, and provide cited primary sources. These sources are why it is my preferred explanation over the speculation required for #1 and #2. I’ll section some source information below, and build to the hypothesis for what could be happening.

GME’s Quarterly Reports are Accurate

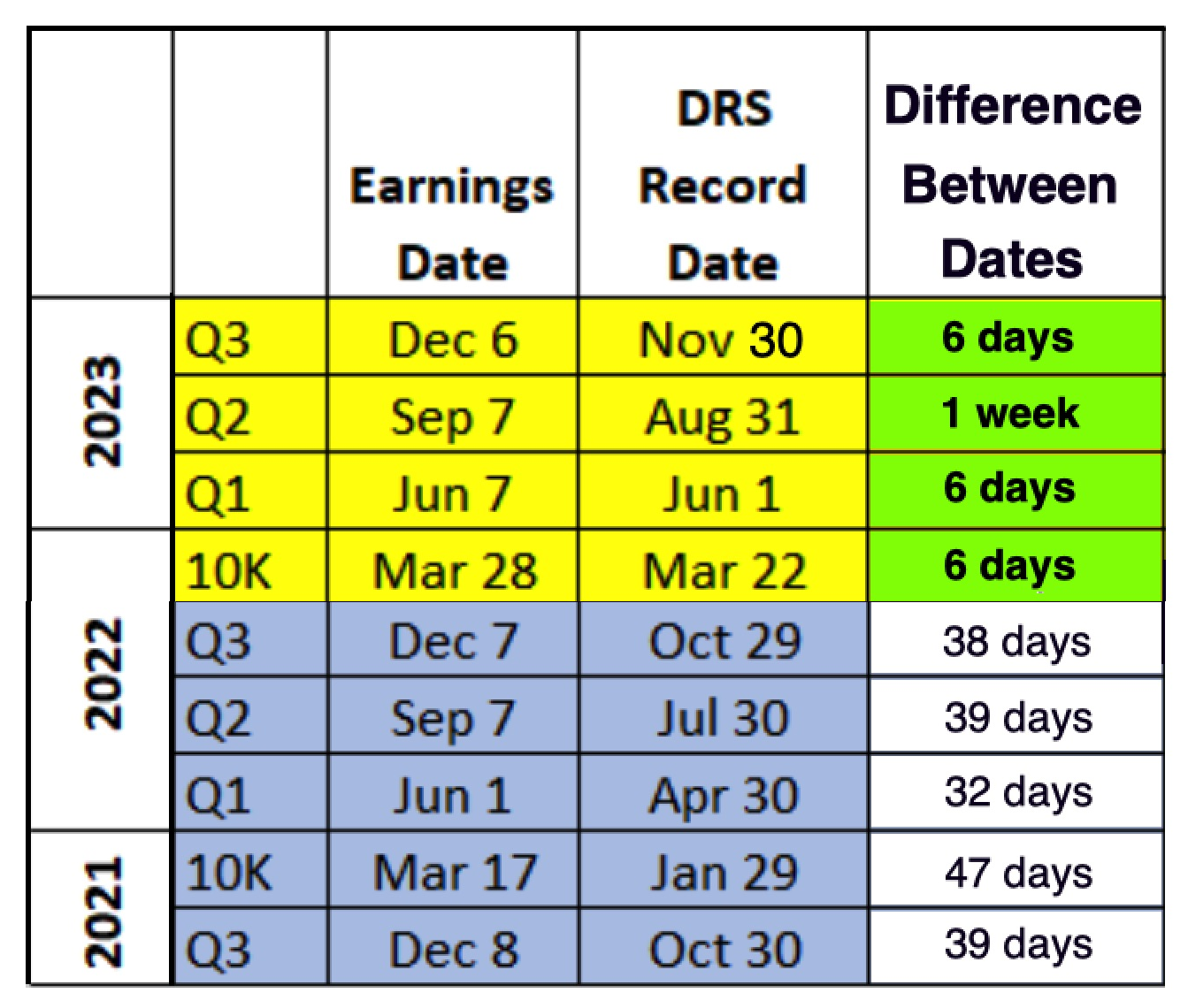

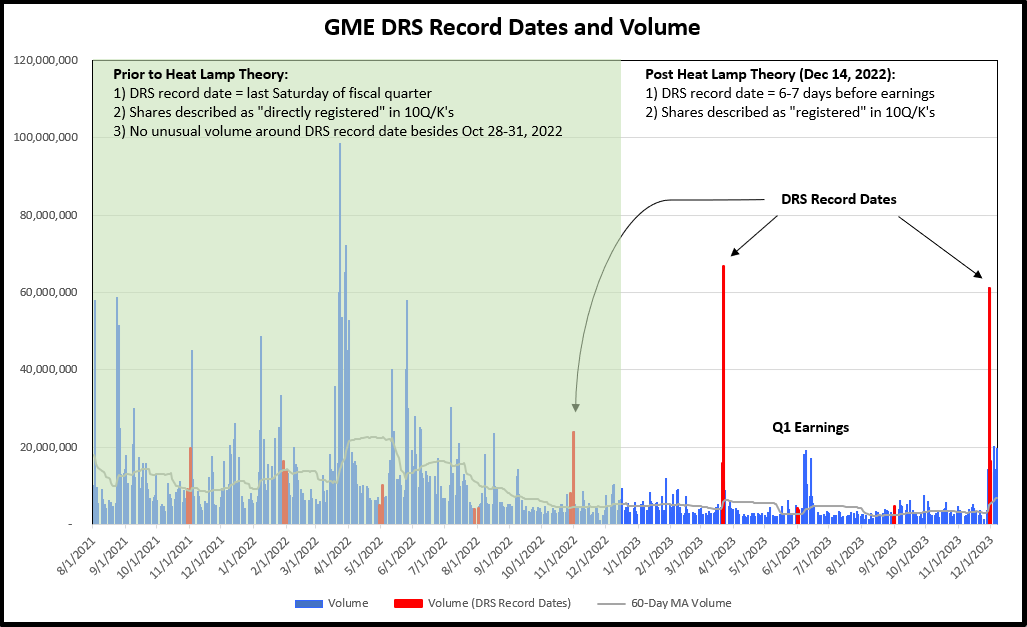

The DRS numbers provided in any of the GME financial reports are provided using a specific record date. Here’s a graph showing every DRS record date and report filing date since DRS reporting began. You can also check these dates for yourself using GME’s SEC Filings directory

We’ll be starting from this assumption, providing and developing some surrounding facts, and then positing an idea to explain accurate DRS reporting and the stagnant numbers at the same time.

TLDR: DirectStock enrolled accounts contribute to a fungible bulk of shares held by Computershare’s nominee. Although these investors are named on the share ledger, they are still beneficial owners. Computershare keeps a portion of the shares which underpin the plan (stated to typically be 10-20%) with the DTC. I believe it is possible that the portion of DirectStock shares which are held with DTC on record dates are not included as DRS shares for the purpose of the DRS reporting on GameStop’s10-Qs throughout 2023.

Whether or not the DTC can use the operational efficiency plan shares for locates is not relevant to this idea. I am only mentioning it because often locates are brought up as part of the DirectStock revelations first posited as part of the heat lamp theory, even though locates have nothing to do with this concept.

Plan is not DRS.

The SEC states the following on an article about the types of ownership available to investors.

“Purchases made through the issuer (or its transfer agent) of securities you intend to hold in DRS are usually executed under the guidelines of an issuer’s stock purchase plan, which uses a broker-dealer to execute the orders. Thus, to hold in DRS once the securities are acquired, you would need to instruct the transfer agent to move the securities from the issuer plan to DRS.” - SEC Bulletin 7/12/23

Similarly, FINRA states the following on an article about the types of ownership available to investors.

“Purchases made through the issuer (or its transfer agent) of securities you intend to hold in direct registration are usually executed under the guidelines of the issuer’s stock purchase plan. You’ll need to instruct the transfer agent to move the securities to the DRS.” - FINRA Investor Insight 7/12/23

Both of these pages were published on the same day.

There has been a false equivalency created in the discourse allowed in some GameStop communities. For example, on Superstonk, moderators often state that “there is no wrong way to hold” and use that as a wedge to limit discussion of ownership details for plan designated shares and DirectStock enrolled investors.

If you are an investor seeking total ownership of your assets, holding in DRS is the only way. Holding shares with the issuer’s transfer agent in an investment plan is better than holding with a broker in terms of named ownership - but DRS holdings are even better. Shares held with a Plan are not DRS, and must be transferred out of the plan and into DRS.

I want to mention here that there is nothing wrong with purchasing through DirectStock if that is what makes sense for you. Many international investors buy GameStop through the plan because DirectStock is much more affordable than buying through a broker and paying them to do a DRS transfer. The fee for DirectStock is $5 and some international brokers cost hundreds of dollars to DRS, so it’s smart to use DirectStock in these cases. You can check your broker’s rates at DRSGME.org.

If you choose to buy through the DirectStock plan, and want to ensure total ownership of your assets, manually terminate the plan after each purchase. This will leave your account with pure DRS holdings.

Here’s our DRSGME guide on terminating DirectStock: https://www.drsgme.org/terminating-from-directstock

What is GameStop’s Investment Plan?

GameStop contracts Computershare as a Transfer Agent to manage it’s stock ledger and distribute shareholder materials such as proxy materials for the annual general meeting.

Computershare offers several proprietary plan structure to interested companies. They have a custom option called CIP (Computershare Investment Plan), they manage DSPs (Direct Stock Purchase) for other companies such as Home Depot in which the issuer can sell stock directly to investors, but the most common plan offering that they have is called DirectStock, and which is billed as a Direct Stock Purchase Plan. The boiler plate DirectStock brochure is located here.

GameStop uses the DirectStock plan.

How is Ownership recorded for Plan shares?

I’ll be using Paul Conn’s public appearances for this section. Paul Conn is President of Computershare Global Capital Markets, and was kind enough to appear multiple times speaking with the broader investor community as they learned more about ownership and direct registration. A full list of his appearances can be found in my post here

Through the selections below, you will see clearly that Computershare has provided the information that Plan is not DRS multiple times over the years and that Paul Conn (representing Computershare) is in agreement with the SEC on this key point. Plan is not DRS. Let’s go through the quotes, and I’ll follow up on the other side. I’ve left them whole and bolded sections which are most important.

GMEJungle AMA with Paul Conn, timestamp for following section is 6:10.

Question: As you discussed in previous interviews. the direct stock purchase plan describes shares that I buy through Computershare that you keep in a separate sort of custodial type account which is different from book shares do I have that right?

Answer: Different from shares held in the DRS form that’s absolutely correct. So shares that are held in DRS are recorded as common shares on the register of the company, so that they’re held in in pure legal form in the investor’s name. Shares that are purchased through the plan are held in a sub-class so they are reported to the issuer just as if they were common shares but the underlying shares are held in a nominee owned by computershare. Those shares however can be moved between the plan and DRS anytime electronically free of charge. The only reason we do this is purely for efficiency. When we’re buying shares, we need to deliver securities into the marketplace so having them available in a nominee helps, so that’s the way it’s structured.

Question: There’s confusion about beneficial (ownership) - does that qualify as what they they consider beneficial versus registered shares? So you’re saying that the direct stock purchase plan would be considered a beneficial ownership situation?

Answer: You’re recorded directly on the register of the issuer. The issuer knows exactly who you are so you have that benefit. **Technically the common shares are held by a computer share entity. ** We don’t hold 100 of the shares that way, we just hold a number of shares so that we can perform effective clearing and settlement but at any time investors can can move their shares between the plan and pure DRS.

An Update on Direct Share Registration, timestamp for following section is 8:09.

Question: As you mentioned there’s been a lot of discussion by social media in particular around the differences between direct shareholdings and direct stock purchase plans. Now I know we’ve updated our FAQs to provide more details on those differences but could you just talk us through the similarities and distinctions?

Answer: Sure. I mean, this is one where I thought we had put sufficient information in the marketplace, but it’s clear over the last two or three weeks over the holiday period that it clearly is some some miscommunication still going on. I don’t know whether that’s misinformation or what so we would try and be very very clear in terms of how the dspp and the drs structures work. To be perfectly clear people should go to the FAQ. I’m going to try to give you a summary of it here but but in essence - If you have a holding of dspp (shares that have been purchased through the direct stock purchase program) they are held in your name on the register just the same way as what I’ve called pure drs. There really is no practical difference to the way the shares are recorded or how they’re visible to the issuer so hopefully that clarifies one key component. For both types you receive your investor communications directly from the company through us as their agent, so again I hope that clarifies. In terms of the direct stock purchase plan you are able to hold fractions - you are not able to hold fractions in what I’ve called pure drs so that is a key practical difference in terms of this structure. The reason there is a difference between these is because in the direct stock purchase plan we use a nominee company that computer share owns and controls to hold the common shares on behalf of all of the investors in the plan. That doesn’t mean the shares are held in DTC and I think that’s where some investors are automatically jumping to the conclusion that because they are beneficially held that they must be in DTC, and that that’s not the case. So in this situation you know it’s really important for people to make their own minds up as to which account they want to leave their shares in. **They can freely transfer their shares electronically from the plan to the DRS environment. ** We’ve said that before, there’s no charge for doing that, I think what we’ve noticed is people are saying you ought to / you must transfer your shares from the plan into pure DRS and I’m not quite sure why people have chosen to do that. It’s their choice after all but what we’ve seen and read is that where people are transferring whole shares from the plan to pure DRS they’re also at the same time selling their fraction. I’m not quite sure why they’re doing that and it’s not our job to question why they are or why they aren’t but people should you know feel free to leave their securities in the plan if that’s what they want to do and please use the faq that’s the primary way in which we’ll communicate these very technical differences but I hope I can give you a flavor through this communication what some of the subtle differences are - but by and large they’re the same form of holding the same underlying share.

Question: Are there any differences in the way that DRS and DSP shares are reported?

Answer: Not to the company no. I mean they’re all… Paul Conn holds shares in pure drs form and hold shares in the plan, the company will be able to see both of those holdings so no no none whatsoever. And, that’s probably the key difference where people might be getting confused about. If some underlying shares supporting the plan are held in drs form then they must be in dtc and therefore they can’t be visible to the company. I think that’s maybe where the misunderstanding has arisen from, but that’s not the case.

An update on Fractional and Plan Shares from Computershare’s Paul Conn, timestamp for following section is 0:22.

Question: So we’ve seen a recent increase in online discussion around fractional shares and around plan shares. What do you think is driving that increase?

Answer: You know, I’m not completely sure. I have been keeping track of some of the narrative but I think at the core of it there is a concern among some investors that if any Shares are held in DTC that that must be a bad thing. I’m not sure we subscribe to that point of view and I’m happy to talk about how the plan is constructed so that we can you know create some uh Clarity some transparency and remove some of the confusion so let’s just go through it.

Question: Can you recap how it works, can we talk about what percentage is generally held both in and outside of DTC?

Answer: So I think today we have always said that we maintain a portion of the underlying shares within DTC, that’s actually true, it was then it is today. Typically we would hold somewhere between 10 and 20 percent of the shares that underpin the plan through our broker at DTC. We’ve previously confirmed with our broker and notified people through the FAQ that those shares are not available to be loaned. The balance of the shares, the 80 to 90 percent, sit on the register also through a computer share subsidiary and those two pots (the 10 plus the 90 or the 20 plus the 80) underpin all of the shares that we record in the individual investors names within the plan. So that’s how the reconciliation works. We need to maintain a small portion of the inventory at DTC so that we can have effective settlement when people are selling but hopefully that clarity will remove some of the confusion about, you know, what portion actually is within the system and the system being the DTC system and if they’re in the DTC system does that mean they’re automatically being lent.

Computershare’s FAQ for Investing in US Listed Companies

“Computershare holds a portion of the aggregate DSPP book-entry shares via its broker in DTC for operational efficiency, i.e. to enable any sales to be settled efficiently (and Computershare determines the portion needed for operational efficiency reasons. Such shares are not available for lending. These shares are eligible to be withdrawn from DTC).”

Susanne Trimbath’s Interpretation

“Proof that the directly registered shares are not available to DTC or any broker FOR ANY PURPOSE is in the fact that, for example, @Computershare has to put some shares in a DTC account to settle any trades they do to maintain the plan.”

Okay - what can we learn from all of this?

There is a clear difference in Plan and DRS ownership, as stated by the SEC and Computershare.

It is true that both of these are recorded directly on the issuer ledger and the investor names are provided to the issuer as two distinct lists. The key difference for plan enrolled shares is that the investor is listed by name in a subclass, and the shares are owned by a Computershare entity - their nominee. Investors are beneficial owners in this case.

Those shares contribute to the fungible bulk which Computershare maintains access to in order to facilitate market transactions. They will typically keep 10-20% of this fungible bulk with DTC in order to effect more efficient settlement for their clients who choose to sell. The Computershare FAQ specifies that Computershare decides this percentage.

Computershare has a subsidiary broker which is also a DTC Member Broker called Computershare Trust Co NA.

DTC Member List - see ‘participants’.

Computershare Trust Co NA maintains the DRS Sales Facility

DirectStock enrollment is what determines whether or not your shares are accessible through Computershare’s nominee to be moved to DTC for operational efficiency purposes. If you hold total legal ownership of your shares by holding directly on the issuer ledger through Computershare while also avoiding account enrollment with DirectStock, you know that your shares will not ever be part of the shares kept with DTC for operational efficiency.

What Enrolls an Investor in DirectStock?

When making a direct purchase, you will automatically be enrolled in DirectStock and shares will appear as “plan” on the investor center in Computershare. This is treaded ground, and many investors have decided to transfer their plan designated holdings to book designated holdings within the Computershare platform.

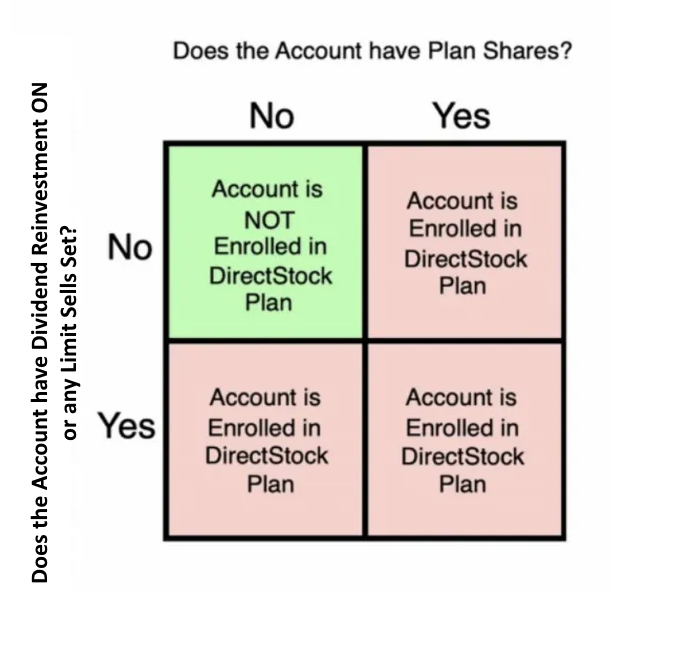

But - did you know that even if you have 0 plan shares in your account, you may still be enrolled in “the plan”, DirectStock?

If you have fractional shares, you are enrolled. If you have plan shares, you are enrolled. If you have DRIP enabled, you are enrolled. If you have a limit sell set, you are enrolled.

Here’s a handy graphic which can help to tell at a glance if you are enrolled.

If at any time you are unenrolled and then make a new purchase (adding plan shares to your account), turn on DRIP, or set a new limit sell - you will be automatically enrolled in DirectStock.

Plan shares are not DRS. If you seek total ownership, use the Terminating from DirectStock guide to move all shares to DRS.

Note: If you terminate, any fractional shares will be sold. Typically sales come with a $25 fee, but if your fractional is worth less than $25, Computershare will process the sale and you will not be charged the difference.

Why is DirectStock enrollment so important?

Plan is distinct from DRS.

Computershare has a public history asserting that investors in plan are beneficial owners, and the purpose of the distinction is to allow for more liquid markets and efficient settlement.

DirectStock enrollment can be unintuitive, with some investors enrolling by accident or assuming they have terminated when they have not.

Now, it’s time to wrap back around to the beginning.

The DRS reporting dates chosen for the financial filings sometimes have much higher volume than the surrounding dates. Heat Lamp was positing that higher volume would lead to a larger % of shares kept with DTC for OE, since that higher volume likely translated to requiring more shares on hand for settlement. Graph made by LawsonDT of DRS record dates and volume

While this does not hold true for every report in 2023, Mainstar’s 1.2mil share clawback to Cede took place in the Q2 reporting cycle.

If the record dates are known to DTC ahead of time, participants could orchestrate higher volume, which will allow more access DirectStock shares for operational efficiency, and then when the snapshot for DRS they have custody of shares kept with them. This could allow a control of reporting results to 76mil.

It’s a different question why controlling to 76mil would be important. Curiously, this was the original float size at time of the Jan 2021 sneeze.

Solid write up, Chives.

76mil… original float size at time of Jan 2021 sneeze.

I’ve picked up on this, too, and also wonder if there’s any significance toward it.

Static DRS counts paired with massive volume spikes… I know it looks like DTC is doing a last minute switcharoo to satisfy reporting requirements but that would be highly illegal.

Surely there’s a mundane explanation for the constellation of weirdness that surrounds GME, it couldn’t be crime.

Remember when they fixed everything after the Big Short?

/s

A network and regime such as “Wall Street” is most definitely not historically or contemporarily known to commit crimes. They defintiely aren’t habitual offenders. No way.

/s just in case.

Thanks so much Chives for writing this post. I’ve been hoping for some additional perspectives on this situation and this is the clearest one yet.

It’s a nuanced but very significant distinction. It isn’t immediately obvious when Paul Conn is speaking, the true implications of what he is saying. I don’t think at any point Paul is lying, he is just saying a bunch of true statements that don’t give the full picture. The sentiment he gives is that there is no practical difference, just some technical differences. This isn’t even necessarily inaccurate. It’s just misleading.

Initially, long before this discussion ever came up, I always assumed that “my shares are with Computershare, so they are DRSd,” a belief that was ignorant of the existence of distinction of Plan aka DSPP aka DirectStock, and DRS.

What I’ve come to learn and understand over the last year or so is that just because my shares are with Computershare does not mean that they are all in DRS. In a practical sense it might seem that way because they are all accessible through the same account.

This is a very excellent post that provides a fresh look on this topic.

DRS provides true share ownership. Plan is not DRS. Plan shares are not DRS shares.

True share ownership is with DRS. Plan shares do not provide true share ownership.

As for what Computershare is really doing with Plan shares at various times, this is something that is still unclear to me.

I like having true share ownership, and I don’t like it when then DTC or anyone else uses my investment for their own purposes. All my shares are 100% pure DRS.

DRS provides true share ownership. Plan is not DRS. Plan shares are not DRS shares.

True share ownership is with DRS. Plan shares do not provide true share ownership.

The perfect takeaway to my post. Glad it was helpful!

DRS(book). Comment on proposals and to representatives. Shop at your favorite store.

Great DD!

Awesome write-up! Thank you!

Great write-up of information that needs to be widespread. Additionally, bananyabangarang showed me that Mainstar put my IRA share acct as being enrolled in the Plan.

At least this information won’t be censored here.

Nice work man, how can we get this to the masses?

Share where you can, let people know that the SEC and Computershare agree - in terms of ownership, Plan is not DRS.

One way to help is spread the message to users on other platforms. Talk about DRS as much as you can and there is even stickers and business cards that are created by the whydrs team to help spread the DRS message IRL

Please please please also post this DD on r/GME on reddit … the more eyes see this the better.

I just crossposted there, and linked back to here as well. I did need to remove a couple of sentences which linked to DRSGME.org as you aren’t allowed to mention DRSGME.org on r/GME, it seems.

Thanks for the suggestion!

https://www.reddit.com/r/GME/comments/18ekym1/crosspost_from_lemmy_why_are_drs_numbers_stagnant/

Thanks for taking an extra step!

Great write up Chives. The more we learn about DRS and actually owning your shares so no broker can get their hands on them the better!

This makes it obvious.

For anyone who maybe didn’t read through the entire post or understand everything:

If you buy shares through Computershare - those shares are NOT “DRSed” until you terminate DirectStock aka “Plan.” See the source from the SEC here - go to the third to last bullet point under Direct Registration and read the last sentence there.

Wait, how many shares do all the board/insiders have? Are they held at computershare or do they have to be held at cede due to some SEC law?

Board and insiders are not held in direct registration. They are most often held in direct beneficial ownership, but sometimes also with indirect beneficial ownership - we know this due to how the form 4s are being filed whenever their ownership changes.

Here’s an example, from when Lawrence Cheng bought shares most recently. Table 1 Column 6 specifies beneficial ownership.

"Both direct and indirect beneficial ownership of securities shall be reported. Securities beneficially owned directly are those held in the reporting person’s name or in the name of a bank, broker or nominee for the account of the reporting person. In addition, securities held as joint tenants, tenants in common, tenants by the entirety, or as community property are to be reported as held directly. If a person has a pecuniary interest, by reason of any contract, understanding or relationship (including a family relationship or arrangement), in securities held in the name of another person, that person is an indirect beneficial owner of the securities. See Rule 16a-1(a)(2)(ii) for certain indirect beneficial ownerships. " taken from https://www.sec.gov/about/forms/form4data.pdf

Direct beneficial ownership is not the same as direct registration. I am under the impression that insiders can choose to hold through DRS if they want, so I am not sure why GME’s insiders choose otherwise. Would welcome corrections if anyone has more info on that.

❤️༼ つ ◕_◕ ༽つ DD on Lemmy❤️

Do you think that a shorter securities transaction settlement cycle could require additional shares to be held at the DTC for operational efficiency? In other words, to move the drive-thru line faster, you store more burgers under the heat lamp?

Great question. I really am not sure how I feel about that!

On one hand, the settlement cycle itself is almost not relevant to the way the market operates. High frequency trading profiting of a magnitude more trades with a smaller and smaller spread … and of course and perhaps most importantly, the lax expectations from market makers. FTDs roll over, Reg SHO is ineffective, single stock ETFs fill the gap.

The only part of the massive system which evades these shortfalls is DRS. The issuer ledger ultimately defines who really claims legal ownership and who has an entitlement from their broker.

So on the other hand… You could be on to something there. If settlement times were longer, the lead time exists to wait for other shares to become available. If some limit sells through Computershare fire, there is a business day to replace them (add more burgers under the lamp). If there was no extra day, how would you argue against keeping all the burgers under the lamp at once? Can’t ever let customers go hungry. What if the whole country got hungry at once?

Really neat thought experiment. It led me to another one.

Can a share sold or removed from DRS be FTD?

Could you break this down a little more ELI5?

Nevertheless, I think you’re looking at a facet/dynamic/function/? of the issue and market that isn’t often looked at - and brings with it some possible insight.

Operational Efficiency is the term used to describe keeping plan shares at the DTCC despite being directly registered to a real owner (this is called the Directstock Plan).

- It is often likened to a heat lamp at a burger place; cooking burgers for orders that don’t yet exist.

- Similarly, Operational Efficiency is taking your [plan] shares for sell orders you haven’t made yet. 🤮

- For those aware of Trimbath’s work, leaving your shares in DTCC clutches is a guarantee they will be used as locates for net settlement of FTDs. 🤑

Operational Efficiency is anathema to our creed of owning our stocks by ourselves. The phantom shares and FTDs that shorts abuse to weaken our long positions are just further urgency to leave DTCC’s crooked broker system. 💎💪

Now in contrast, the alternative to Directstock Plan is DRS.

When shares are directly registered under DRS, there is no operational efficiency: burgers are made to order and actual stock is only moved when a real sale occurs. DTCC gets to cry and pound sand as we invest in the market without their oversight 💎👌

TLDR

- The broker system relies on repurposing their customers’ long positions as locates for their own short positions (see Naked, Short, and Greedy by Trimbath)

- When a DRS owner buys a share they are settled with an actual share

- When anyone else buys a share they get rehypothecated promise from DTCC to have the share available by the time you decide to you sell it; you never actually get the share.

More knowledgeable apes please feel free to add corrections or improvements here 💎✌️

Edit: corrections, thanks king 🍻

Re: locates. I apologize I’m trying to not actually connect those dots, I’m seek to use one to discredit the other:

- On one hand DTCC lets brokers fuck you with locates. This tells me the broker system cheats you, full stop. This is evident from Trimbath.

- On the other these same crooks have their hands on your shares under the guise of operational efficiency. This tells me that the crooks I seek to escape have their hands in my cookie jar. This is evident from Paul Conn’s YT statement and that SEC bullet point about how plan isn’t DRS.

- To be clear, I wish to say: given their behavior in the broker system, how can anyone trust them that Operational Efficiency is bona fide and not just another broker-style pretense for fuckery?

See you on the moon 💎💪💎💪🚀 🚀🚀🦍 🦍🦍🦍

Great writeup! I do have some thoughts but you clearly know your stuff. 🙂

- Operational efficiency isn’t just taking your plan shares for sell orders you haven’t made yet - since DirectStock acts as a fungible bulk, they are used for sell orders coming from anyone who holds that stock with Computershare.

- Although Trimbath has written a lot about locates when shares are at all connected to DTC, I haven’t seen anything that’s proven operational efficiency shares specifically can be located. That’s why I like to push the true and provable angle that if you want total and legal ownership you should unenroll from the plan.

- I’d say the alternative to DirectStock/Plan is not Book, but DRS. I know the popular narrative has been book vs plan but I would like to try to change that. Book is too similar to Book Entry, which is the technical name for all electronic shares (meaning DRS shares, DirectStock shares, shares in brokers, etc). All electronic uncertificated shares are book entry. Computershare does list DRS shares as Book in investor center, but not all transfer agents do this. It’s a choice Computershare makes. If you replaced ‘Book’ with ‘DRS’ in the rest of your post you would be spot on.

got dam! 👍 👍 👍 👍

Because all of this nonsense is a farce. https://youtu.be/5pYeoZaoWrA?si=y94rhbUZhUT2DuKK

Everybody has a hobby. Some people like building model trains, bird watching, dancing on TikTok… We like investigating corruption in the stock market. Lemmy is big enough for all of us. 💜