It’s really unreasonable how I continue to require food each and every single day despite many attempts to just not.

Sorry everyone! Didn’t mean to let you all down. Will try harder next time.Please stop breathing while you are at it. You are causing global warming!

/S

Yeah, haven’t you ever tried not eating? Or better still, what about just not living! Don’t knock 'til you’ve tried it serfs.

Sorry guys forgot to turn off the inflation switch when I went to pee

Again!? One more time and we’re going to have a serious conversation!

SPEND MORE MONEY YOU POOR FUCKS. YOU CAN’T EXPECT THE 1% TO HELP!

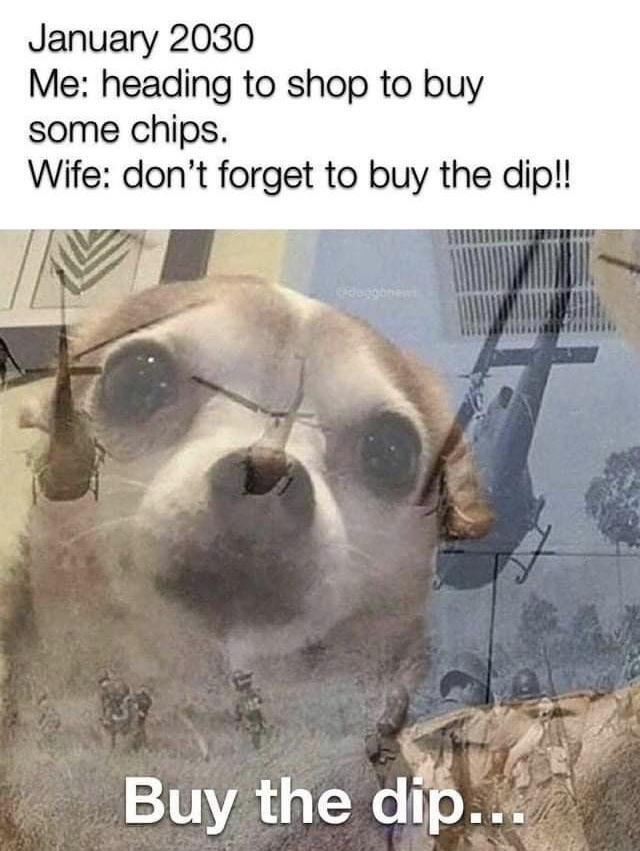

People hate inflation, just not enough to spend less: This is one of the central tensions of today’s economy, in which things are going great yet everyone is miserable. And in some ways, Americans have nobody to blame but themselves.

The article is mostly paywalled, but seems based on the opposite idea, that inflation is “too much money chasing too few goods”, I.e. demand-pull inflation. Inflation would go down if people just bought less stuff, the idea is.

I always hear the argument that to help the economy, people need to spend more. I am also seeing that some people just go further into debt in order to not compromise their quality of life. Both are bad and not helping apparently 😂

It’s like households being told to stop wasting water, or petrol, when companies aren’t held accountable to the same degree. The average person simply cannot tip the scales in the same way that a multinational corporation can. Or the 1% or 0.1% even.

I don’t accept any assertion based on theories whose base assumption is that Humans are rational.

Eh, touche. Though, that’s a bit extreme and binary, I’d say. Sometimes humans are rational and sometimes (a lot) they/we are not.

When some difficult concepts are explained to me (cryptography, quantum mechanics, Quaternions, etc. Are some concepts i recently visited) the gears grind in my head. I understand SOMETHING at the end of the ordeal.

But you try to explain me economic theory, various instruments for holding wealth, how stocks with voting powers work and I come out of it convinced it’s an elaborate obfuscation invented to dodge taxes, launder ill-gotten gain, confuse normal people so they lose money to the hedge funds, trap companies and take them over.

Everything about financial markets is anxiety inducing and give off a “Hey, this thing has weird loopholes… pretty sure some rich dude is making good use of it to siphon money out of the general population” vibe.

Well put. I can relate and think you articulated the problem well. When it’s all said and done, the greater “stock market” and Wall Street network is simply irrational, unreasonable, opaque, and illogical - largely by design and on purpose. The only way it becomes “rational” and “reasonable” and “logical” is when viewed through a lens of corruption and deception.

That’s not what the last article is saying at all. It’s saying the opposite. I know you didn’t make this meme, but do you kids even know the definition of inflation.

Try the Australian method. Raise interest rates with the hope that a lot of the population will have less money now and this will lead to spending habit changes that force prices down. That is bound to work especially when it comes to essentials like groceries. Actual outcome

But yes it does mean that people have less money now.

Edit: fixed links

That’s how literally every central bank works. If there’s too much money chasing not enough goods, you get inflation. The only way to solve it is to either make more things or reduce the amount of money. Central banks can’t do anything about the former, so they concentrate on the latter by raising interest rates.

You’re not wrong about interest banks, but in regards to inflation you actually have it backwards. Inflation is the expansion of currency, not the rise of prices. Definitions get entangled because inflation causes a rise in prices, and people don’t know better. Expanding the currency increases the market availability of said currency, thus making it less valuable relative to other goods.

Think about the word inflation. If you inflate something, are you raising it, or making it bigger? Inflating a balloon with helium is not the act of raising the balloon, but rather expanding the balloon. That expansion triggers a rise when it’s helium. Likewise, inflating the currency is to expand the amount of currency.

Inflating the currency too much causes there to be too much money chasing not enough goods, as you describe

We can debate semantics, but the practical reality is that it is how it’s measured and for inflation that’s CPI, which is a measure of prices.

Italian method is even better. Explicitly write on the annual budget law that a priority of all measures is to avoid any increase of salaries. Because it would “add inflation”. Italy has the lowest salaries in EU after Greece…

Suppressing salaries as a response to unsustainable market dynamics is like eating rocks to help you swim upstream

Write it to Giancarlo Giorgetti, but I don’t think he would understand

Inflation doesn’t come from employee salaries or wages. Inflation is an expansion of the currency, and the only thing that can increase the amount of currency is the central bank that generates it.

Your hyperlinks point to “url” unless my app is busted.

Fixed.

I’m pretty sure all of those are real headlines (came across a completely 'shopped NYT headline and writer on X lately - take this as a reminder!) - the last one is real, at least: https://www.theatlantic.com/ideas/archive/2023/12/inflation-prices-buying-habits/676191/

INFLATION IS YOUR FAULT If people are so mad about high prices, why do they keep buying so many expensive things?

By Annie Lowrey

People hate inflation, just not enough to spend less: This is one of the central tensions of to

Rest is paywalled. Anyone have the rest?

Sounds US centric though while inflation is global.

I totally read this a ‘rest (as in relaxation) is paywalled’. And yes it is. When moass happens, I’m doing something I have not done in over a decade. Taking a vacation.

You need a Paywall Bypass solution STAT. You’re missing out on so much content.

Maybe they’re becoming aware that their currency is being inflated away and losing purchasing power every day and are grabbing as much as they can before it vanishes? Dunno, just a thought.

deleted by creator

It is satisfying to see a post from our community pop up in my feed while browsing through all.

https://fred.stlouisfed.org/series/M1SL

I guess I’m the one who printed all the money since 2020.“Victim blaming isn’t real!” Victim blaming:

It’s clowns all the way down. Just ask Paul Clownman here.

I didn’t realise I was a high payed ceo price gouging the public

Well, yeah… but that’s kind of the OH!

You mean economic!

I don’t even read the Atlantic articles

Well tbf, some of their stuff is good. But this one is from ‘the Atlantic, Ideas’ which is probably an opinion piece. Opinion pieces are more a reflection of the author than the publication. So fuck who ever wrote this. But don’t hate the entire company

Inflation is DEFINITELY my fault

purrs in Furry

4th panel should be:

“This is related to my favorite obsolete funkopop novelty store”

@Zuberi is allowed to post memes related to the broader economy –– they don’t have to be specifically about GameStop. If you want, I can make a connection though: supply and demand. Refer to the comment and citation by @Pogogunner on the increase in M1.

The banks have been printing more money (demand), but there is still the same amount of stuff to buy (supply) –– so everything costs more. Short sellers print more shares of companies (supply), but there is still the same number of shareholders (demand) –– so the shares cost less. The high price at the grocery store and the low price of GameStop are both fake –– to the detriment of everyday people who shop and invest.

Ha! Eh, kinda sorta.

This is more related to the corruption on Wall Street and associated regulating agencies.

The fact of the matter, at the end of the day and what this community is primarily focused on, is that if you/someone you know holds stocks/retirement securities with a brokerage (TD Ameritrade, Robinhood, Schwab, etc…), you do not - unequivocally - actually own those shares. That lack of true ownership equates to gargantuan loopholes and widespread fraud. It’s known as “street name” registration.

Street name

Registration under which securities maybe held by a broker on behalf of a client but be registered in the name of the Wall Street firm.

https://www.nasdaq.com/glossary/s/street-name

About 83% of people in the markets have “their” stocks in “street name” registration.

Cede owns 83% of all issued stocks in the United States.[6] The other 17% of all issued stocks is owned by directly registered holders through the direct registration system.