Breaking down “the GameStop story” into chapters. This is a general overview for reference purposes and is not a definitive guide.

Please feel free to provide any feedback, fact checking, or criticism of what is presented here.

Prior to 2019 - the original GameStop of the before times

The GameStop company as most people knew it and continue to perceive it, that retail store in the mall where you could go to trade in your old games for a pittance.

Who would ever believe that a company such as this would ever have any major significance?

2019 through 2020: the pre-sneeze

In 2019, Michael Burry takes a GME position, writes some letters to the company’s board of directors suggesting changes. Burry eventually exits his GME position at a not-insignificant gain by December 2020.

RoaringKitty aka DeepFuckingValue also sees an opportunity in GME and takes a position and begins promoting it on YouTube and Reddit (specifically wallstreetbets). DFV’s bold position is appreciated by many, and he eventually leads a large and enthusiastic online following.

Ryan Cohen buys ~ 9% stake in the company, eventually increasing that position to around ~ 13%.

By the end of 2020, there is accelerating momentum on the stock that precipitates the sneeze.

January 2021 through March 2021: the sneeze, and immediate aftermath

Ryan Cohen receives 3 seats on the board of directors.

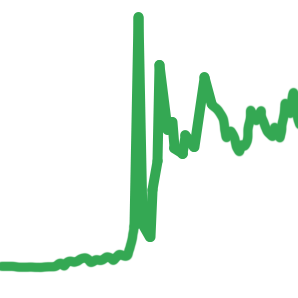

Due to unrelenting social media excitement and purchasing by small time investors, the price of GME continually accelerates, eventually becoming a practically straight vertical upward line.

This is it. Retail investors won. They bought, they held, they kept buying, there’s nothing that will stop this movement. The short hedge funds have lost. Game over.

Except it wasn’t. Do you really think that power holding incumbents wouldn’t abuse their unfair power advantage to screw over small time retail investors that were winning? Multiple brokers and clearing firms colluded to prevent retail from buying any more shares of GME for a period of several days, enough time for the momentum to be killed and for those incumbents to catch up and reposition themselves.

The outcome of this dramatic act was that the price of GME lost its momentum and fell dramatically, something that was beneficial to any incumbent that was holding a GME short position or otherwise had liabilities related to the situation.

Very importantly, GME shorts never closed their short positions, despite any paid promotions or other misinformation stating otherwise.

Congress holds a hearing and summons DFV to answer for his role in this situation. DFV handles it like a pro and proceeds to double down on GME.

The price of GME, after having fallen dramatically from the peak, begins rising once again.

March 2021 through June 2021 - reverberations from the sneeze and an opportunity for GameStop to raise money

Despite that the sneeze was over and the intense momentum which caused it had dissipated to some degree, the trading price of GME remained highly elevated throughout most of 2021.

GME investors migrate away from wallstreetbets and into superstonk and other subreddits.

In April, GameStop takes advantage of the high share price and completes the first of 2 large at-the-market offerings (ATMs), raising roughly half a billion dollars for the company.

In June, the board of directors becomes fully replaced with Ryan Cohen and his allies. Ryan Cohen becomes chairman of the board of directors. RC is now the largest individual shareholder of the company and as chairman has full authority of the company’s leadership.

Later in June, GameStop completes the second of the 2 large ATMs, raising an additional ~ billion dollars in cash, totaling approximately $1.7 billion from both ATMs.

The company was now flush with cash and had an entirely new leadership team and a new direction. A strong position to be in to begin the execution of a turn around of an old company with decades of mismanagement and neglect.

July 2021 through December 2021 - DRS discovered and initiated

The company was working on a turnaround. However, Rome was not built in a day. The turnaround of GameStop was not something that would happen overnight.

A large number of individual investors remained bullish on the company. But the act of simply buying shares of GME and holding them was no longer producing any obvious desired effect in the market, the way that it did back before the sneeze. The market was now back in control of the price.

What more could motivated individual investors do?

Back in April, superstonk had an interview with Dr. Susanne Trimbath, author of the book Naked Short and Greedy. This interview introduced to the hive mind the idea of DRS for the first time. The idea of DRS percolated for several months, and by September, investors started posting their paper letters from Computershare, and eventually their purple circles, showing that they had directly registered their shares.

Perhaps because other ideas were exhausted and that DRS was a novel action that remained open for motivated investors, or perhaps for some other reason entirely, DRS was soon at the front of the hive mind’s conscious attention.

In December, GameStop posted 2021 Q3 earnings report which stated: “As of October 30, 2021, 5.2 million shares of our Class A common stock were directly registered with our transfer agent, ComputerShare.”

This was the first time any such quarterly report made mention of directly registered shares, and was received by the investor community as undeniable evidence from the company itself that DRS was an important endeavor, putting to rest a large degree of doubt which persisted around the idea.

December 2021 through end of 2022 - DRS to 25%

The consensus of the investor hive mind, despite some lingering doubt and resistance, was that DRS was the way.

For the next year, quarterly reports showed a persistent increase in the number of shares DRS’d, which was very bullish for investors that believed in it. But then, as of Q3 2022, published December 7th 2022, the number of shares that were DRS’d generally flat-lined at approximately 25% of all shares, and has remained near that level since.

Beginning of 2023 to present - loss of momentum, community divisions, an apparent stalemate

The fact that even 25% of all officially issued shares of GME have been directly registered is no small feat. At a trading price of around $25 per share near the end of 2022, this amounted to nearly 2 billion dollars worth of shares that were directly registered by a group of roughly 200,000 individual investors, the vast majority of which were people of modest means, not wealthy individuals, competing in an arena dominated by the ultra wealthy.

But, 25% falls short of what might have been expected by this point. The DRS train appears to have run out of steam.

A variety of reasons have been speculated to be the cause of this flat-lining of the DRS rate. These speculative discussions came with controversy and precipitated community division (and who might benefit from controversy and division within the GME investor community?)

For whatever the true reason, by the authority vested in the mods of superstonk, the largest subreddit and community of GME investors, these types of conversation were suddenly no longer welcome to be had there.

As a consequence of this crackdown on discussing details about DRS, the community of investors was fractured. Investors started to migrate to new community locations because certain important conversations were no longer able to be had in superstonk. Superstonk itself has since lost a large degree of enthusiasm and community spirit (who benefits?)

Despite anything and everything that has happened up to this point, the trading price of GME continues to trend downwards to fresh all-time-lows from the peak of the sneeze.

Critics of GME investors and GameStop look at the downward trend of the share price since the sneeze as indisputable proof of a trajectory that inevitably ends at zero. After all, how could an investment that apparently only trends downward be considered a good investment?

Present time, late 2023 - competing narratives (psychological warfare); pre-moass

Despite whatever has happened up to this point, good or bad, the situation persists.

The existence of a large amount of sustained cynicism and opposition towards GameStop and GME investors in the media and on social media demonstrates that some faction out there continues to have a big problem with the idea that GameStop might ever be successful. GME as an investment continues to be contrarian and controversial, because incumbents with a vested interest in GameStop’s demise want it need it to be perceived by the masses as contrarian and controversial and dubious, for the sake of their own survival.

Moass is an idea that takes many forms and has many implications. Most people who continue to believe in that idea and all of its implicit absurdities to this day (this author included) initially expected it to be an event that should have already happened by now, but it has not.

Yet, the conditions for such an event remain.

Some hedge funds opened large GME short positions that were never closed, persisting as an existential liability.

GameStop is in the strongest financial position that it has been in since whatever glory it might have had in the before times, and continues to explore new avenues to grow revenue.

The current leadership of the company regularly demonstrates their commitment to the long term success of the company.

We find ourselves in this zero-sum game where competing factions stand to gain everything from, or lose everything to their opponents, who are on opposite sides of GameStop’s potential success or failure.

Victory for one side necessarily requires the capitulation of the other side, and neither side shows any inclination of backing down.

hey thanks! I’m glad somebody enjoyed it. i put this together just to have a rough outline of the story that i can refer to later. i’m working on a version of this for https://gmetimeline.org/guide that will be more interactive.