TLDR: GameStop capitalizes on high share price to raise nearly $1.7 billion in cash across several months. This warchest reinvigorated the company by enabling it to clear out debts, overhaul legacy business components, fund new initiatives, and in general provide a cushion as the new leadership team began the monumental turnaround of the company.

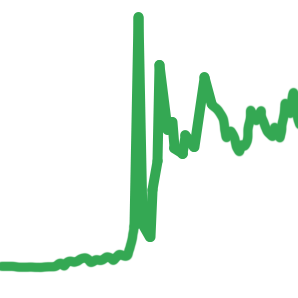

On April 5, 2021, GameStop completed the first of 2 At-The-Market Equity Offering Programs (ATMs).

“The Company ultimately sold 3,500,000 shares of common stock and generated aggregate gross proceeds before commissions and offering expenses of approximately $551,000,000.”

On June 22, 2021, GameStop completed the second of the 2 ATMs.

“The Company ultimately sold 5,000,000 shares of common stock and generated aggregate gross proceeds before commissions and offering expenses of approximately $1,126,000,000.”

During the Ryan Cohen GMEdd interview, RC was asked:

"Founding a company poses a different set of challenges than transforming a legacy business. How are Chewy and GameStop different or alike?

RC responded: “They’re both contrarian. Selling, – you know there were all the comparisons with Chewy to pets.com, and then GameStop to Blockbuster, it was harder to raise capital at Chewy, it was, you know, every time we raised capital we basically had one option, when we were hiring was very difficult we were unknown quantity in Florida, I’d say at GameStop, you know, we’ve been able to raise capital, we’re fortunate that we were able to do two ATMs, it’s been easier to hire, being in the public markets and having that level of visibility… with GameStop it’s a known quantity already, and we’ve got a business and a foundation to build off of, but having said that, it’s a foundation that was under invested in for a very very long time and we’ve been working really hard to restore and rebuild that foundation.”

By raising nearly $1.7 billion in cash, the possibility of any near term bankruptcy was eliminated.

In terms of debt, as of January 30, 2021, the company carried a total of debt of $362.7 million. As of May 1, 2021, the company carried a total debt of $48.1 million.

In the GMEdd interview, RC stated: “We inherited a bunch of legacy everything, and under-investment across the entire business – people, the entire technology stack, just decades of neglect and so it’s hard to turn around a brick and mortar retailer that’s under the kind of pressure that GameStop was and continues to be under.”

Having raised this money by completing these 2 ATMs, GameStop was now in a strong position to begin to fix problems and and steer towards a successful future.

As of the most recent quarterly results (July 29, 2023), GameStop holds $894.7 million in cash and cash equivalents, and practically negligible long term debt of only $23.6 million.