Ravi didn’t know it, but he, like millions of Americans, was trapped in a “ghost network.” As some of those people have discovered, the providers listed in an insurer’s network have either retired or died. Many other providers have stopped accepting insurance — often because the companies made it excessively difficult for them to do so. Some just aren’t taking new patients. Insurers are often slow to remove them from directories, if they do so at all. It adds up to a bait and switch by insurance companies that leads customers to believe there are more options for care than actually exist.

Ambetter’s parent company, Centene, has been accused numerous times of presiding over ghost networks. One of the 25 largest corporations in America, Centene brings in more revenue than Disney, FedEx or PepsiCo, but it is less known because its hundreds of subsidiaries use different names. In addition to insuring the largest number of marketplace customers, it’s the biggest player in Medicaid managed care and a giant in Medicare Advantage, insurance for seniors that’s offered by private companies instead of the federal government.

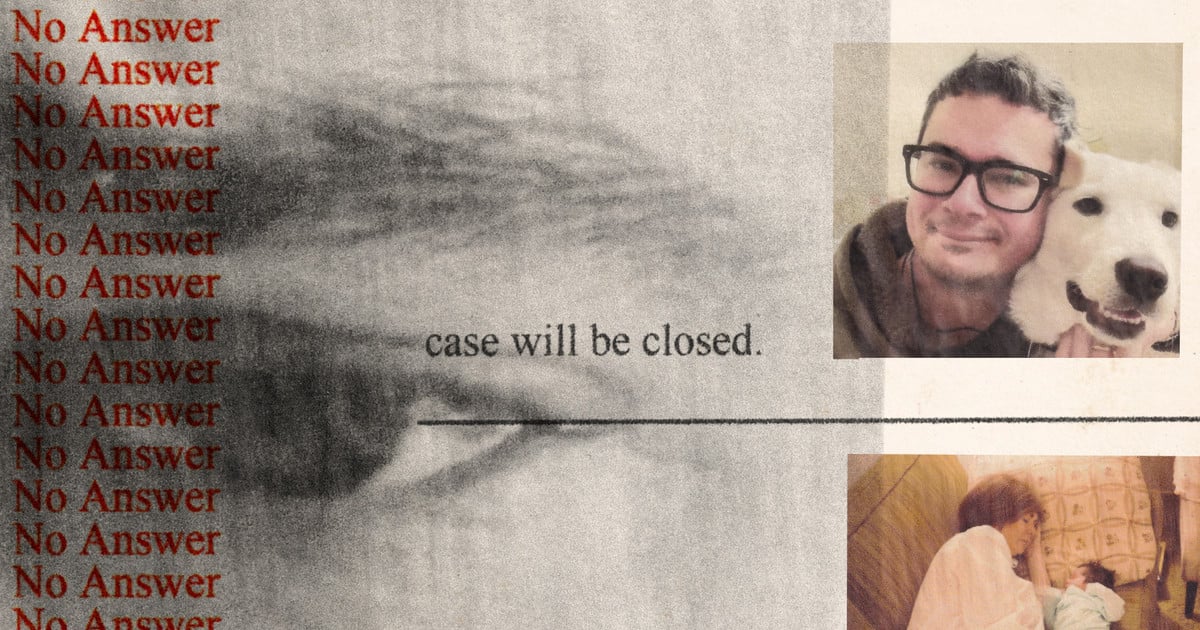

ProPublica reached out to Centene and the subsidiary that oversaw Ravi’s plan more than two dozen times and sent them both a detailed list of questions. None of their media representatives responded.

What does this mean (non-American here), that there are listings to get insurance from, but most aren’t real and just offer what seems to be choice?

The patient has insurance but once you have insurance you have to find healthcare professionals who accept your insurance, doctors don’t have to accept any insurance plan. The insurance company here has a list of health providers that accept their coverage (we call this in network) and you can go to them for care. The insurance company’s list is poorly maintained so many of the listed providers went out of business, stopped accepting the insurance plan, or stopped accepting new patients.

If you go to a doctor that is out of network, the insurance company charges you much much more for the visit if they cover it at all, or you may have to pay completely out of pocket.

And there’s no way to know if you’re covered beforehand?

It’s a maze of craziness where you could be covered by one doctor at a location but the person doing a particular procedure (like radiology) don’t take your insurance. So you can’t know for sure until after you get the bills whether you are covered or not. Every medical event is financial Russian Roulette.

That’s even worse than I thought I already knew.

Imagine you have to choose a health insurance company to be insured with like you choose a credit card (Visa, Mastercard, etc). Many doctors (shops) only accept certain insurance providers (cards) due to fees and other regulations.

The problem described in this article is when your insurance lists doctors that you can go to that will accept your insurance, but most of them have gone out of business or actually don’t accept your particular insurance anymore.

To make things even harder, a lot of people don’t really have much of a choice which insurance provider to use because of cost. I can’t afford insurance outside of what my employer offers.

These are listings of doctors who are in network (= covered by a certain insurance provider), but the reality is these listings are fake, as in no longer correct. Insurance companies keep these listings anyway to create an illusion of choice (aka, I am a good insurer and I have a lot of providers, that are contracted with me, for you to choose from).

People who discover that most of these doctors are unavailable, are effectively denied care or have to resort to out of network doctors that are covered at much lower rate or not covered at all (= higher out of pocket expenses).

It means we need universal health care. Some providers are out of business or have deductibles and copayments that mean they take a lot of money but the people signing up pay a lot to not access care.